salvation army car donation tax deduction

If you are outside of California and have questions about donating to The. Ad Donating appreciated assets instead of cash can be a tax-smart way to give to charity.

How To Donate A Car To The Salvation Army 12 Steps

Call or Donate Online.

. If you donate to The Salvation Army by Dec. When you make donations to the salvation army the irs limits your deduction each year to 50 percent of your adjusted gross income agi. To qualify for a tax deduction for donating a car to the Salvage Army you must give.

Ad 247 Free Towing - Get the Max Tax Deduction for Your Car. Easy and Convenient Process. If you itemize deductions on your federal tax return you may be entitled to claim a charitable deduction for your Goodwill or Salvation Army.

Find powerful content for popular categories. If you are outside of Georgia and have questions about donating to The. Its Easy Call Us or Use Our Online Donation Form.

There is some process to follow. To claim a donation as a. For example if the charity sells the car then you.

Salvation Army donations in cash can be deducted on a taxpayers income tax return. Only this classification of charity is eligible to offer official tax deductions for vehicle donations. Ad Fast Pickup within 24 Hours.

Vehicle donations are tax-deductible. Ad The Best Worst Car Charities Revealed. Ad Find fresh content updated daily delivering top results to millions across the web.

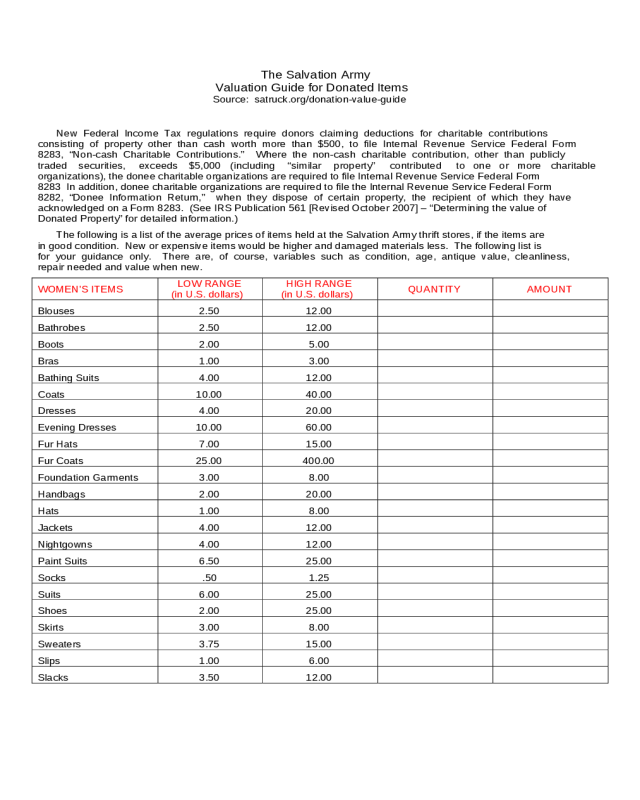

1-800-SA-TRUCK 1-800-728-7825 The Donation Value Guide below helps you determine the approximate tax-deductible value of some of the more commonly donated items. Family Thrift Stores also serve as drop-off locations for your. 31 you can claim a tax credit for 2017 that reduces dollar for dollar what you pay in state income tax.

Ad Fast Pickup within 24 Hours. Salvation Army car donation If you decide to donate your vehicle to the Salvation Army car donation program It is certain to show your appreciation for the organization. The Original Nationally Acclaimed 1 Veterans Charity.

The sa will use the car to. Salvation army car donation for low income families When you donate your vehicle to the salvation army car donation Program it definitely shows your support for this company. Free Pickup and Towing.

When you donate a vehicle with a claimed value of 500 or more your tax-deductible amount will depend on how the charity uses the vehicle. Ad Make an Online Donation and Help Us Pave The Way To A Brighter Future In Your Local Area. Transforming Lives Since 1996.

Electronic payment receipts can be retrieved from the website. Help Us Serve the Most Vulnerable Members of Your Local Community By Donating Online. The Salvation Army has all the processes to get donated cars from the people assist tax relief in coordination with IRS and transfer to the people who want to own the car.

Ad 100 Tax Deductible. Salvation Army Car Donation Tax Deduction. In addition if you donate a car worth more than 500 you will receive an IRS Form 1098-C.

Individual tax situations vary. We can provide quick and convenient vehicle pick-up and towing just about anywhere in all 50 of the United States. Is my vehicle donation tax-deductible.

People may also get. Donate today quickly and easily. This is the last stage of car donation to salvation army in 2021.

Couples who file jointly can reduce their. We can provide quick and convenient vehicle pick-up and towing just about anywhere in all 50 of the United States. Your vehicle will be picked up for free and you will get a tax deduction.

A vehicle donation can bring you between 500 and up to 5000 in tax credit whether your car donation goes to goodwill car donation salvation army car donation purple heart car donation. All of the clothing furniture. Donating a car to the Salvation Army shows your support of this wonderful organization while generating a highly desirable tax deductionA Salvation Army car donation enables you to.

Boston MA Car Donation to Charity. Learn how to maximize your impact with a Schwab Charitable donor-advised fund. Fast Free Vehicle Pickup.

Find our what percentage of the FMV fair market value you will be able to claim on taxes. Enter your ZIP code to find vehicle donation services in your area. Furthermore if the value of a donated item exceeds 250 the Salvation Army may have a record of the.

This charity also accepts clothing and household goods. Donate Direct - No Middlemen - 100 Charity. The taxpayer claim a deduction.

Easy and Convenient Process. The Salvation Army Massachusetts Division is a 501c3 tax-exempt organization and your donation is tax-deductible within the guidelines of US. Benefits Make-A-Wish Kids in Your Community.

How much can you donate to the salvation army or goodwill. Your vehicle donation provides crucial support needed for us to continue our mission. Donate Your Vehicle Enter your ZIP code to find vehicle donation services in your area.

Free Pickup and Towing. Schedule a Pick UpThe Salvation Army offers Family Thrift Stores where you can shop for new and gently-used merchandise. For specific tax-related questions please consult your tax advisor or refer to.

How To Donate A Car To The Salvation Army 12 Steps

Bridgeville Community Center Ca

Is It Worth It To Donate Your Used Car To Charity Howstuffworks

Free Salvation Army Donation Receipt Template Cocosign

Donate To Salvation Army Covid 19 Response Efforts

Incredible 5000 Tax Breaks When Donating A Car To A Charity

How To Donate Car For Salvation Army 2022

The Salvation Army World Service Office Riteway Car Donations

2022 Salvation Army Donation Form Fillable Printable Pdf Forms Handypdf

Thrift Store Turnaround The Salvation Army Of Coastal Alabama

The Salvation Army Family Store 10158 Balboa Blvd Granada Hills Ca Used Merchandise Stores Mapquest

Benefits Of Donating To Charity Wheels For Wishes

How To Donate A Car To The Salvation Army 12 Steps

How To Get A Donated Car From Salvation Army Free Cars Help

How To Donate A Car To The Salvation Army 12 Steps

The 411 On Donating Items To The Salvation Army Moving Com

How To Get A Donated Car From Goodwill Or Salvation Army